UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.___ )

Filed by Registrant ☑ | ||

Check the appropriate box: | ||

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☑ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under § 240.14a-12 | |

NETGEAR, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

☑ | |||

No fee required | |||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||

(1) | Title of each class of securities to which transaction applies: | ||

(2) | Aggregate number of securities to which transaction applies: | ||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) | Proposed maximum aggregate value of transaction: | ||

(5) | Total fee paid: | ||

☐ | Fee paid previously with preliminary materials. | ||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

�� | (1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | ||

(3) | Filing Party: | ||

(4) | Date Filed: | ||

Thursday, May 28, 2020

10:00 a.m. Pacific Daylight Time

To Our Stockholders:

The 20162020 Annual Meeting of Stockholders of NETGEAR, Inc. will be held on Friday, June 3, 2016,Thursday, May 28, 2020, at 10:00 a.m. Pacific Daylight Time at our executive offices at 350 East Plumeria Drive, San Jose, California 95134Time. The Annual Meeting will be a completely virtual meeting of stockholders conducted via live audio webcast. You will be able to attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/NTGR2020.

We are holding the Annual Meeting for the following purposes:

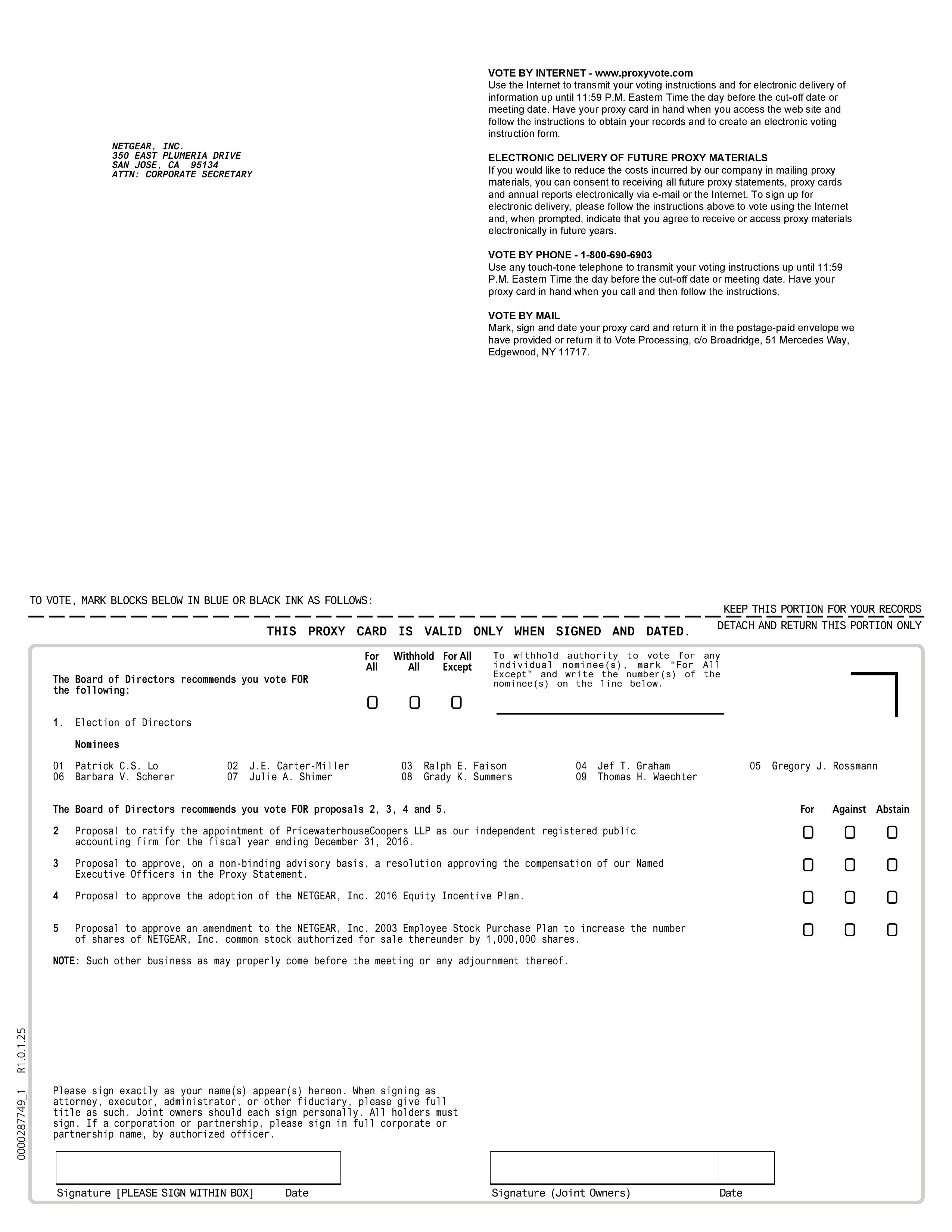

1. | To elect |

2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

3. | To approve the non-binding advisory proposal regarding executive compensation; |

4. |

To approve an amendment to the NETGEAR, Inc. |

5. | To vote on a proposal submitted by a stockholder regarding the right of stockholders to act by written consent, if properly presented at the meeting; and |

6. | To transact such other business as may properly come before the annual meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary, or before any adjournment thereof. |

Stockholders who owned shares of our stock at the close of business on Monday, April 4, 2016March 30, 2020 are entitled to attendnotice of and to vote at the meeting. A complete list of these stockholders will be available during normal business hours for 10 days prior to the meeting at our headquarters located at 350 East Plumeria Drive, San Jose, California 95134. A stockholder may examine the list for any legally valid purpose related to the meeting. The list also will be available during the annual meeting for inspection by any stockholder present at the meeting.

Whether or not you plan to attend the annual meeting,virtual Annual Meeting, we hope you will vote as soon as possible. If you received or requested printed proxy materials, you may vote by mailing a proxy or voting instruction card. If you received a Notice Regarding the Availability of Proxy Materials (the “Notice”), you may vote over the Internet. Please review the instructions on each of your voting options described in the proxy materials, as well as the Notice if you received one.

For the Board of Directors of | ||||

NETGEAR, INC. | ||||

| ||||

Patrick C.S. Lo | ||||

Chairman and Chief Executive Officer | ||||

San Jose, California | ||||

April 20, 2020 | ||||

YOUR VOTE IS IMPORTANT

Page | |

2 | |

2 | |

3 | |

3 | |

3 | |

4 | |

4 | |

4 | |

5 | |

6 | |

7 | |

7 | |

7 | |

10 | |

10 | |

11 | |

12 | |

12 | |

12 | |

13 | |

14 | |

15 | |

15 | |

16 | |

17 | |

17 | |

18 | |

19 | |

19 | |

20 | |

21 | |

21 | |

22 | |

23 | |

25 | |

26 | |

27 | |

27 | |

30 | |

31 | |

32 | |

32 | |

37 | |

41 | |

42 | |

42 | |

44 | |

45 | |

Adjustments to NETGEAR Equity Awards due to the Arlo Spin-Off | 47 |

48 | |

i

ii

PROXY STATEMENT FOR THE

2020 ANNUAL MEETING OF STOCKHOLDERS

The enclosed Proxy is solicited on behalf of the Board of Directors of NETGEAR, Inc., a Delaware corporation, for use at the Annual Meeting of Stockholders. The Board of Directors has made these materials available to you on the Internet or in printed proxy materials in connection with the solicitation of proxies for use at its 20162020 Annual Meeting of Stockholders, which will take place at 10:00 a.m. Pacific Daylight Time on Friday, June 3, 2016 at its executive offices located at 350 East Plumeria Drive, San Jose, California 95134.

This proxy statement contains important information regarding our annual meeting. Specifically, it identifies the proposals on which you are being asked to vote, provides information you may find useful in determining how to vote and describes the voting procedures.

We use several abbreviations in this proxy statement. We may refer to our Company as “NETGEAR,” “we,” “us” or “our.” The term “proxy materials” includes this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2015,2019, as well as the proxy or voter instruction card if you received or requested printed proxy materials.

We are mailing the proxy materials on or about April 20, 20162020 to all of our stockholders as of the record date, April 4, 2016.March 30, 2020. Stockholders who owned NETGEAR common stock at the close of business on April 4, 2016March 30, 2020 are entitled to attend and vote at the annual meeting. A complete list of these stockholders will be available at our headquarters located at 350 E. Plumeria Drive, San Jose, California 95134, during normal business hours for 10 days prior to the meeting. A stockholder may examine the list for any legally valid purpose related to the meeting. On the record date, approximately 32,494,99329,592,321 shares of our common stock were issued and outstanding and no shares of our preferred stock were issued and outstanding. We had 2228 stockholders of record as of the record date and our common stock was held by approximately 14,96117,178 beneficial owners.

You may also view this proxy statement, as well as our Annual Report on Form 10-K for the year ended December 31, 2015,2019, online at the following address: http://materials.proxyvote.com/64111Q.

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to the proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials (the “Notice”) to some of our stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the proxy materials and on the website referred to in the Notice. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

As a stockholder, you have the right to vote on certain business matters affecting us. The five (5) proposals that will be presented at the annual meeting, and upon which you are being asked to vote, are discussed in the sections entitled “Proposal One,”One” through “Proposal Two,” “Proposal Three,” “Proposal Four,” and “Proposal Five.”Five” below. Each share of NETGEAR common stock you own entitles you to one vote.

Voting by Mail.

If you received or requested printed proxy materials, then by signing and returning the proxy or voter instruction card according to the enclosed instructions, you are enabling our Chairman and Chief Executive Officer, Patrick C.S. Lo, and our Chief Financial Officer,Your shares will be voted in accordance with the instructions you indicate on the proxy or voter instruction card. If you submit the proxy or voter instruction card, but do not indicate your voting instructions, your shares will be voted as follows:

FOR the election of the director nominees identified in Proposal One;

FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016;2020;

FOR the non-binding advisory proposal regarding executive compensation;

FOR the approval of an amendment to the NETGEAR, Inc. 2003 Employee Stock Purchase2016 Equity Incentive Plan to increase the number of shares of NETGEAR, Inc. common stock authorized for saleissuance thereunder by 1,000,000 shares.2,000,000 shares; and

AGAINST the stockholder proposal regarding the right of stockholders to act by written consent;

Voting over the Internet.Internet or by Telephone. If you received the Notice (as described above), you can vote by proxy over the Internet or by telephone by following the instructions provided on the Notice.

Voting in PersonElectronically at the Meeting.

To reduce the expenses of delivering duplicate voting materials to our stockholders who may have more than one NETGEAR stock account, we are delivering only one set of the voting materials to certain stockholders who share an address unless otherwise requested. For stockholders receiving printed proxy materials, a separate proxy card is included in the voting materials for each of these stockholders. If you share an address with another stockholder and have received only one set of voting materials, you may request a separate copy of these materials at no cost to you by writing our Corporate Secretary at NETGEAR, Inc., 350 East Plumeria Drive, San Jose, California 95134, or

2

calling our Corporate Secretary at (408) 907-8000. For future annual meetings, you may request separate voting materials, or request that we send only one set of voting materials to you if you are receiving multiple copies, by writing or calling our Corporate Secretary. You may receive a copy of NETGEAR's Annual Report on Form 10-K for the year ended December 31, 20152019 including the Consolidated Financial Statements, schedules and list of exhibits, and any particular exhibit specifically requested by sending a written request to NETGEAR, Inc., 350 East Plumeria Drive, San Jose, California 95134, Attn: Corporate Secretary.

You may revoke your proxy at any time before it is voted at the annual meeting. In order to do this, you may do any of the following:

sign and return another proxy bearing a later date;

provide written notice of the revocation to the Company's Corporate Secretary, at NETGEAR, Inc., 350 East Plumeria Drive, San Jose, California 95134, prior to the time we take the vote at the annual meeting; or

attend the meeting and vote in person.electronically at the virtual Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

A quorum, which is a majority of our outstanding shares as of the record date, must be present in order to hold the meeting and to conduct business. Your shares will be counted as being present at the meeting if you appear in person atattend the meeting, if you vote over the Internet, or if you submit a properly executed proxy or voter instruction card.

The vote required, and method of calculation for the proposals to be considered at the annual meeting, are as follows:

Proposal One - Election of Directors.

Proposal Two - Ratification of the Appointment of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2016.2020. Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm will require the affirmative vote of a majority of the shares present at the annual meeting and entitled to vote, in person or by proxy. You may vote “for,” “against,” or “abstain” from voting on this proposal.

Proposal Three - Approval of the Non-Binding Advisory Proposal Regarding Executive Compensation.

Approval of the non-binding advisory proposal regarding executive compensation will require the affirmative3

vote of a majority of the shares present at the annual meeting and entitled to vote, in person or by proxy. You may vote “for,” “against,” or “abstain” from voting on this proposal.

Proposal Four - Approval of an Amendment to the NETGEAR, Inc. 2016 Equity Incentive Plan. Approval of an amendment to the NETGEAR, Inc. 2016 Equity Incentive Plan will require the affirmative vote of a majority of the shares present at the annual meeting and entitled to vote, in person or by proxy. You may vote “for,” “against,” or “abstain” from voting on this proposal.

Proposal Four - ApprovalFive – Stockholder Proposal Regarding the Right of the Adoption of the NETGEAR, Inc. 2016 Equity Incentive Plan.

If you return a proxy or voter instruction card that indicates an abstention from voting on all matters, the shares represented will be counted as present for the purpose of determining a quorum, but they will not be voted on any matter at the annual meeting. Consequently, if you abstain from voting on Proposals Two Three, Four orthrough Five, your abstention will have the same effect as a vote against such Proposal(s).

A “broker non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner as to how to vote on that proposal. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum but are not counted for determining the number of votes cast for or against a proposal.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name.” If you hold your shares in street name, it is critical that you cast your vote if you want it to count in the election of directors (Proposal One), the approval of the advisory vote regarding our executive compensation on an advisory basis (Proposal Three), the approval of the adoption ofamendment to the NETGEAR, Inc. 2016 Equity Incentive planPlan (Proposal Four), and the approvalstockholder proposal regarding the right of an amendmentstockholders to the NETGEAR, Inc. 2003 Employee Stock Purchase Planact by written consent (Proposal Five). If you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote for Proposal One, Proposal Three, Proposal Four or Proposal Five, no votes will be cast on your behalf for those Proposals.

Your bank, broker or other nominee will, however, continue to have discretion to vote any uninstructed shares on the ratification of the appointment of our independent registered public accounting firm (Proposal Two).

We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing and mailing of proxy materials. We expect our Corporate Secretary, Andrew W. Kim, to tabulate the proxies and act as inspector of the election. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners. Our directors, officers and employees may also solicit proxies in person or by other means of

4

communication. Such directors, officers and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation.

As a stockholder, you may be entitled to present proposals for action at a forthcoming meeting if you comply with the requirements of the proxy rules established by the Securities and Exchange Commission. Proposals by our stockholders intended to be presented for consideration at our 20172021 Annual Meeting must be received by us no later than December 21, 20162020 (120 calendar days prior to the anniversary of the mailing date of this proxy statement), in order that they may be included in the proxy statement and form of proxy related to that meeting. The submission of the stockholder proposal does not guarantee that it will be included in our 20172021 proxy statement.

The Securities and Exchange Commission rules establish a different deadline with respect to discretionary voting for stockholder proposals that are not intended to be included in a company's proxy statement. The proxy card grants the proxy holders discretionary authority to vote on any matter raised at the annual meeting. The discretionary vote deadline for our 20172021 Annual Meeting is March 6, 2017,2021, which is 45 calendar days prior to the anniversary of the mailing date of this proxy statement. If a stockholder gives notice of a proposal after the discretionary vote deadline, our proxy holders will be allowed to use their discretionary voting authority to vote against the stockholder proposal when and if the proposal is raised at our 20172021 Annual Meeting.

In addition, our amended and restated bylaws establish an advance notice procedure with regard to specified matters, including stockholder proposals and director nominations, which are proposed to be properly brought before an annual meeting of stockholders. To be timely, a stockholder's notice shall be delivered no less than 120 days prior to the date of the annual meeting specified in the proxy statement provided to stockholders in connection with the preceding year's annual meeting, which is February 3, 2017January 28, 2021 in connection with our 20172021 Annual Meeting. In the event that no annual meeting was held in the previous year or the date of the annual meeting is changed by more than 30 days from the date contemplated at the time of the previous year's proxy statement, notice by the stockholder must be received not later than the 10th10th business day following the day notice of the date of the meeting was mailed or public disclosure was made, whichever occurs first.

In 2016, we amended our amended and restated bylaws to permit a stockholder, or group of up to 50 stockholders, owning continuously for at least three years shares of our common stock representing an aggregate of at least 3% of our outstanding shares, to nominate and include in our proxy statement director nominees constituting up to the greater of two directors or 20% of the of the total number of directors then serving on our Board of Directors, provided that the stockholder(s) and nominee(s) satisfy the requirements specified in our amended and restated bylaws. Notice of such “proxy access” director nominees for our 20172021 Annual Meeting must be received no earlier than November 21, 20162020 (150 calendar days prior to the anniversary of the filing date of this definitive proxy statement) and no later than December 21, 20162020 (120 calendar days prior to the anniversary of the filing date of this definitive proxy statement).

A stockholder's notice shall include the information required by our amended and restated bylaws. A copy of the full text of our amended and restated bylaws is available in the investor relations section of our website at www.netgear.com. Proposals or nominations should be sent to our Corporate Secretary, c/o NETGEAR, Inc., 350 East Plumeria Drive, San Jose, California 95134.

Stockholders may communicate directly with any of our directors by writing to them c/o NETGEAR, Inc., 350 East Plumeria Drive, San Jose, California 95134. Unless the communication is marked “confidential,” our Corporate Secretary will monitor these communications and provide appropriate summaries of all received messages to the Chairperson of our Nominating and Corporate Governance Committee. Any stockholder communication marked “confidential” will be logged as “received” but will not be reviewed by the Corporate Secretary. Such confidential correspondence will be immediately forwarded to the Chairperson of the Nominating and Corporate Governance Committee for appropriate action. Where the nature of a communication concerns questionable accounting or auditing matters, such communication will be directed to the Audit Committee and our Corporate Secretary will log the date of receipt of the communication as well as (for non-confidential communications) the identity of the correspondent in the Company's records.

The nine (9)eight (8) nominees for election at the Annual Meeting of Stockholders are Patrick C.S. Lo, Jocelyn E. Carter-Miller, Ralph E. Faison,Laura J. Durr, Jef T. Graham, Bradley L. Maiorino, Janice M. Roberts, Gregory J. Rossmann, Barbara V. Scherer Julie A. Shimer, Grady K. Summers and Thomas H. Waechter. If elected, they will each serve as a director until the Annual Meeting of Stockholders in 2017, and2021, or until their respective successors are elected and qualified or until their earlier resignation or removal.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for election of all of the director nominees, all of whom currently serve as directors. In the event the nominees are unable or decline to serve as a director at the time of the annual meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. We are not aware that any nominee will be unable or will decline to serve as a director. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as to assure the election of the nominees listed above.

The name and agenames of the nominees and incumbent directorscertain biographical information about them as of April 3, 2016, the principal occupation of each and the period during which each has served as our directorMarch 30, 2020 are set forth below. Information as to the stock ownership of each of our directors and all of our current directors and executive officers as a group is set forth below under “Security Ownership of Certain Beneficial Owners and Management.”below:

Name |

| Age |

|

| Office |

| Director Since | |

Patrick C.S. Lo |

|

| 63 |

|

| Chairman and Chief Executive Officer/Nominee |

| 2000 |

Laura J. Durr |

|

| 59 |

|

| Director/Nominee |

| 2020 |

Jef T. Graham |

|

| 64 |

|

| Director/Nominee |

| 2005 |

Bradley L. Maiorino |

|

| 49 |

|

| Director/Nominee |

| 2018 |

Janice M. Roberts |

|

| 64 |

|

| Director/Nominee |

| 2019 |

Gregory J. Rossmann |

|

| 58 |

|

| Director/Nominee |

| 2002 |

Barbara V. Scherer |

|

| 64 |

|

| Director/Nominee |

| 2011 |

Thomas H. Waechter |

|

| 67 |

|

| Director/Nominee |

| 2014 |

| Name | Age | Office | Director Since | |||

| Patrick C.S. Lo | 59 | Chairman and Chief Executive Officer/Nominee | 2000 | |||

| Jocelyn E. Carter-Miller | 58 | Director/Nominee | 2009 | |||

| Ralph E. Faison | 57 | Director/Nominee | 2003 | |||

| Jef T. Graham | 60 | Director/Nominee | 2005 | |||

| Gregory J. Rossmann | 54 | Director/Nominee | 2002 | |||

| Barbara V. Scherer | 60 | Director/Nominee | 2011 | |||

| Julie A. Shimer | 63 | Director/Nominee | 2007 | |||

| Grady K. Summers | 39 | Director/Nominee | 2016 | |||

| Thomas H. Waechter | 63 | Director/Nominee | 2014 | |||

Patrick C.S. Lo

is our co-founder and has served as our Chairman and Chief Executive Officer since March 2002. Mr. Lo founded NETGEAR with Mark G. Merrill with the singular vision of providing the appliances to enable everyone in the world to connect to the high speed internet for information, communication, business transactions, education, and entertainment. From 1983 until 1995, Mr. Lo worked at Hewlett-Packard Company, where he served in various management positions in sales, technical support, product management, and marketing in the U.S. and Asia. Mr. Lo was named the Ernst & Young National Technology Entrepreneur of the Year in 2006. Mr. Lo received a B.S. degree in electrical engineering from Brown University. Mr. Lo's experience as a founder and Chief Executive Officer of the Company gives him unique insights into the Company's challenges, opportunities and operations.Laura J. Durr has served as one of our directors since January 2009. From 2004 to the present,2020. Ms. Carter-Miller hasDurr served as President of TechEdVentures, Inc., a consulting and management firm that develops and markets high-performance personal and community empowerment programming. From February 2002 until March 2004, Ms. Carter-Miller served asthe Executive Vice President and Chief MarketingFinancial Officer of Office Depot,Polycom, Inc. from May 2014 until its acquisition by Plantronics Inc. in July 2018. Prior to that, she spent a decade with Motorola, initially as a Directorbecoming Chief Financial Officer, Ms. Durr held various finance leadership roles at Polycom between

7

2004 and 2014, including Senior Vice President-Worldwide Finance, Chief Accounting Officer and Worldwide Controller. Prior to joining Polycom, Ms. Durr held executive positions in finance and administration at Lucent Technologies and International Network Service Quality, Vice PresidentServices and GM of International Networks Division Latin America and EMEA Operations and ultimately as Corporate Vice President and Chief Marketing Officer. She also spent eightsix years at Mattel in marketing, product developmentPrice Waterhouse LLP. Ms. Durr also serves on the board of directors of TiVo Corporation. Ms. Durr was a certified public accountant and strategic business planning roles. Ms. Carter-Miller is a member of the Board of Directors of the Principal Financial Group, Inc., the Interpublic Group of Companies, Inc. and a non-profit organization. Ms. Carter-Miller is a NACD Directorship 100 recipient. Ms. Carter-Miller holds a B.A. degreeB.S. in Accounting from the University of IllinoisSan Jose State University. Ms. Durr provides valuable operational and an M.B.A. from the University of Chicago. Ms. Carter-Miller provides in-depth understanding of marketing to home usersstrategic experience and small businesses based oninsight, given her extensive marketingbackground in finance and executive experience. Her experience on the boards of large public companies provides important perspective of governance and other practices to be applied to NETGEAR.

Jef T. Graham

has served as one of our directors since July 2005. Since September 2019, Mr. GrahamBradley L. Maiorino has served as one of our directors since July 2018. Since May 2019, Mr. Maiorino has served as the Chief Information Security Officer at Thomson Reuters Corporation, a leading provider of business information services. From April 2017 to May 2019, Mr. Maiorino served as an Executive Vice President at Booz Allen Hamilton Inc., a management and technology consulting firm. From June 2014 to April 2017, he served as Senior Vice President and Chief Information Security Officer at Target Corporation, the second largest general merchandise retailer in the United States. From July 2012 to June 2014, Mr. Maiorino was the Chief Information Security and Technology Risk Officer at General Motors Company, an automotive manufacturing and financing services company. Prior to that, from April 2001 to July 2012, he held various leadership roles in the technology organization of General Electric Company, a global digital industrial company, ultimately serving as Chief Information Security Officer for the company. Mr. Maiorino holds a B.S. degree in professional computer studies from Pace University. Mr. Maiorino brings more than 25 years of experience, with diverse business experience and a track record of building and leading global teams within Fortune 50 firms. He has a deep understanding of technology, security and risk management, and also has significant contacts and relationships in the technology and security community.

Janice M. Roberts has served as one of our directors since February 2019. Ms. Roberts is an experienced global technology executive and venture capitalist based in Silicon Valley, where her board experience spans public, private, and nonprofit organizations. Since April 2014, she has been a partner at Benhamou Global Ventures, where she invests in early stage “cross-border” companies including SaaS, AI-powered platforms, collaboration and IoT solutions. Ms. Roberts currently serves on the boards of Zebra Technologies, Inc. and Zynga Inc., and was most recently a director of RealNetworks, Inc. for nearly 10 years, until 2020, and of ARM Holdings Plc until its acquisition by the SoftBank Group in 2016. From 2000 to 2013, Ms. Roberts served as Managing Director of Mayfield Fund, where

8

she continued as a venture advisor until 2014, investing in wireless, mobile, enterprise and consumer technology companies. From 1992 to 2000, Ms. Roberts was employed by 3Com Corporation (later acquired by Hewlett Packard), where she held various executive positions, including Senior Vice President of Global Marketing and Business Development, President of 3Com Ventures and President of the Palm Computing Business Unit. She also serves on the advisory board of Illuminate Ventures and is Co-Chair of GBx Global.org, a curated network of British entrepreneurs and senior technology executives in the San Francisco Bay Area. Ms. Roberts holds a Bachelor of Commerce degree (honors) from the University of Birmingham in the U.K. Ms. Roberts provides our Board with a valuable perspective based on her extensive executive and board-level experience with technology companies in multiple product areas and sectors, including networking and communications products, software, microprocessor technology, gaming and applications, spanning consumer, business and service provider markets.

Gregory J. Rossmann has served as one of our directors since February 2002. Since April 2016, Mr. Rossmann has served as a General Partner at Oak Investment Management, a late stage growth and private equity investor. From February 2009 to March 2016, Mr. Rossmann was a private investor. From November 2007 to January 2009, Mr. Rossmann served as a Managing Director of The Carlyle Group, a private equity firm. From April 2000 to November 2007, Mr. Rossmann served as a Managing Director of Pequot Capital Management, Inc., a private equity firm. From April 1994 to April 2000, Mr. Rossmann served as Managing Director and partner at Broadview International, an investment banking firm. From June 1991 to April 1994, he worked at Dynatech Corporation, a technology holding company, where he served as manager of new business development. Prior to that, he was a co-founder of Telemaster Corporation.held various Product Management and Engineering positions at Advanced Micro Devices. Mr. Rossmann is a director of several private companies. Mr. Rossmann received a B.S. degree in Electrical and Computer Engineering from the University of Cincinnati and an M.B.A. from Santa Clara University. Mr. Rossmann's extensive technology, private equity, and investment banking experience allows him to provide the Company with unique perspectives and advice on global markets, corporate development, and acquisition initiatives.

Barbara V. Scherer

has served as one of our directors since August 2011. Ms. Scherer9

President and President of the Communications Test & Measurement Group of JDS Uniphase Corp. from 2007 until becoming Chief Executive Officer. Prior to that, Mr. Waechter held a wide variety of executive positions, including Chief Operating Officer at Harris Stratex Networks (now Aviat Networks, Inc.), President and Chief Executive Officer at Stratex Networks, President and Chief Executive Officer at REMEC Corporation and President and Chief Executive Officer of Spectrian Corporation. Additionally, he held a number of global executive-level positions during his 14-year career with Schlumberger Ltd. Mr. Waechter also serves as an Executive Advisor to Tensility Venture Partners and is a National Association of Corporate Directors (NACD) Board Leadership Fellow. He holds a Bachelor of Business Administration from The College of William and Mary. As a recent chief executive officer of a public company and as a prior senior executive in a variety of highly relevant technology companies and international industries, Mr. Waechter provides the Company with extensive operational, strategic and executive management experience.

A nominee receiving the greatesta greater number of votes of the shares present and entitled to vote at the annual meeting“for” his or her election than votes “against” such election will be elected as directors. Stockholders are not entitled to cumulative voting in the election of directors.a director. Pursuant to our corporate governance guidelines, it isBylaws and our policy thatCorporate Governance Guidelines, any nominee for director in an uncontested election who receives a greater number of votes “withheld” from“against” his or her election than votes “for” such election shall submit his or her offer of resignation for consideration by our Nominating and Corporate Governance Committee and our Board of Directors. The election of directors pursuant to this proposal is an uncontested election, and therefore, this majority voting policy will apply.

Our Board of Directors held a total of sixtwelve meetings during 2015.2019. In addition, we strongly encourage the attendance of members of our Board of Directors at the annual meeting. AtAll of our directors attended the 20152019 Annual Meeting of Stockholders all of our then-continuing directors attended in person.

There are no family relationships between any director or executive officer. Our Board of Directors has standing Audit, Compensation, Cybersecurity, and Nominating and Corporate Governance Committees. Other than Mr. Lo, each member of our Board of Directors meets the applicable independence standards and rules of Rule 5602(a)(2) ofboth the listing standards of the Marketplace Rules of the NASDAQNasdaq Stock Market and applicable independence rules of the Securities and Exchange Commission.

10

In 2015,2019, all of our directors attended at least 75%92% of the meetings of our Board of Directors and any applicable committee on which they served while they were members of our Board of Directors or the applicable committee.

Committee |

| Year of Inception |

| Members at the End of 2019 |

| Key Committee Functions |

| Meetings Held in 2019 | |

Audit |

| 2000 |

| Barbara V. Scherer (Chair) Bradley L. Maiorino Janice M. Roberts |

| • Evaluates the adequacy and effectiveness of internal controls over financial reporting, including our disclosure controls and procedures |

| 9 | |

• Appoints independent registered public accounting firm | |||||||||

• Reviews annual audit plan of the independent auditor, the results of the independent audit, and the report and recommendations of the independent auditor | |||||||||

• Reviews and determines the scope, roles and responsibilities of the internal audit function | |||||||||

• Determines investment policy and oversees its implementation • Reviews code of business ethics and conflict of interest policy and related certifications • Oversees related party transactions policy | |||||||||

|

|

|

|

|

|

|

|

|

|

Compensation |

| 2000 |

| Gregory J. Rossmann (Chair) Jef T. Graham Janice M. Roberts Barbara V. Scherer

|

| • Administers our equity plans |

| 6 | |

| • Reviews and approves compensation of directors and officers, and makes recommendations to the Board with respect thereto | ||||||||

• Reviews and recommends general policies relating to compensation and benefits | |||||||||

|

|

|

|

|

|

|

|

|

|

Nominating and Corporate Governance |

| 2004 |

| Thomas H. Waechter (Chair) Jef T. Graham Gregory J. Rossmann

|

| • Recommends nomination of Board members |

| 7 | |

• Assists with succession planning for executive management positions | |||||||||

• Oversees and evaluates Board performance | |||||||||

• Evaluates composition, organization and governance of the Board and its committees | |||||||||

|

|

|

|

|

|

|

|

|

|

Cybersecurity Committee |

| 2017 |

| Bradley L. Maiorino (Chair) Jef T. Graham Gregory J. Rossmann Thomas H. Waechter |

| • Oversees IT systems policies and procedures, including enterprise cybersecurity and privacy |

| 5 | |

• Oversees incident response policies and procedures | |||||||||

• Reviews disaster recovery capabilities | |||||||||

• Oversees IT budgetary priorities | |||||||||

| Committee | Year of Inception | Members at the End of 2015 | Committee Functions | Meetings Held in 2015 | |||||

| Audit (1) | 2000 | Barbara V. Scherer (Chair) Jocelyn E. Carter-Miller A. Timothy Godwin Jef T. Graham | Ÿ | Reviews internal accounting procedures | 10 | ||||

| Ÿ | Appoints independent registered public accounting firm | ||||||||

| Ÿ | Reviews annual audit plan of the independent auditor, the results of the independent audit, and the report and recommendations of the independent auditor | ||||||||

| Ÿ | Evaluates the adequacy of our internal financial and accounting processes and controls | ||||||||

| Ÿ | Determines investment policy and oversees its implementation | ||||||||

| Compensation | 2000 | Ralph E. Faison (Chair) Jocelyn E. Carter-Miller Gregory J. Rossmann Thomas H. Waechter (2) | Ÿ | Administers our equity plans | 7 | ||||

| Ÿ | Reviews and approves compensation of directors and officers, and makes recommendations to the Board with respect thereto | ||||||||

| Ÿ | Reviews and recommends general policies relating to compensation and benefits | ||||||||

| Nominating and Corporate Governance | 2004 | Julie A. Shimer (Chair) Ralph E. Faison Gregory J. Rossmann Thomas H. Waechter | Ÿ | Recommends nomination of Board members | 8 | ||||

| Ÿ | Assists with succession planning for executive management positions | ||||||||

| Ÿ | Oversees and evaluates Board performance | ||||||||

| Ÿ | Evaluates composition, organization and governance of the Board and its committees | ||||||||

Our Board of Directors first adopted a written charter for the Audit Committee in August 2000. A copy of our current amended and restated Audit Committee charter is available in the investor relations section of our website at www.netgear.com. Our Board of Directors has determined that eachat least one member of the Audit Committee is an “audit committee financial expert,” as defined in the rules of the Securities and Exchange Commission. None of the membersNo member of the Audit Committee is an employee of NETGEAR. Ms. Scherer currently serves as Chair of our Audit Committee.

Our Board of Directors first adopted a written charter for the Compensation Committee in August 2000. A copy of our current amended and restated Compensation Committee charter is available in the investor relations section of our website at www.netgear.com. Our Board of Directors has determined that all members of the Compensation Committee meet the non-employee director definition of Rule 16b-3 promulgated under Section 16 of the 1934 Act the outside director definition of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and the independence standards of the applicable NASDAQ

Our Board of Directors formed a Nominating and Corporate Governance Committee and adopted its written charter in April 2004. A copy of our current amended and restated Nominating and Corporate Governance Committee charter is available in the investor relations section of our website at www.netgear.com. None of the membersNo member of the Nominating and Corporate Governance Committee is an employee of NETGEAR. Dr. ShimerMr. Waechter currently serves as Chair of our Nominating and Corporate Governance Committee.

Cybersecurity Committee

Our Board of Directors formed a Cybersecurity Committee in June 2017 and adopted its written charter in August 2017. A copy of our current Cybersecurity Committee charter is available in the investor relations section of our website at www.netgear.com. No member of the Cybersecurity Committee is an employee of NETGEAR. Mr. Maiorino currently serves as Chair of our Cybersecurity Committee.

The Nominating and Corporate Governance Committee considers candidates for Board membership suggested by members of our Board of Directors, management and stockholders. It is the policy of the Nominating and Corporate Governance Committee to consider recommendations for candidates to our Board of Directors from stockholders who have provided the following written information: the candidate's name; home and business contact information; detailed biographical data and qualifications; information regarding any relationships between the candidate and NETGEAR within the last three years; and evidence of the nominating person's ownership or beneficial ownership of NETGEAR stock and amount of stock holdings. The Nominating and Corporate Governance Committee will consider persons recommended by our stockholders in the same manner as a nominee recommended by our Board of Directors, individual Board members or management.

In addition, a stockholder may nominate a person directly for election to our Board of Directors at an annual meeting of our stockholders provided they meet the requirements set forth in our amended and restated bylaws and the rules and regulations of the Securities and Exchange Commission related to stockholder proposals. The process for properly submitting a stockholder proposal, including a proposal to nominate a person for election to our Board of Directors at an annual meeting (either for inclusion in our proxy statement via “proxy access” or not for inclusion in our proxy statement), is described above in the section entitled “General Information - Information—Deadline for Receipt of Stockholder Proposals or Director Nominations for 20172021 Annual Meeting.”

12

Where the Nominating and Corporate Governance Committee has either identified a prospective nominee or determines that an additional or replacement director is required, the Nominating and Corporate Governance Committee may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, the Board or management. In its evaluation of director candidates, including the members of our Board of Directors eligible for re-election, the Nominating and Corporate Governance Committee considers, among other factors:

the current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board; and

such factors as judgment, independence, character and integrity, area of expertise, diversity of experience, length of service, and actual or potential conflicts of interest.

With respect to diversity, the Nominating and Corporate Governance Committee also focuses on various factors such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity; however, the Board and the Nominating and Corporate Governance Committee believe that it is essential that the Board members represent diverse viewpoints.

In connection with its evaluation, the Nominating and Corporate Governance Committee determines whether it will interview potential nominees. After completing the evaluation and review, the Nominating and Corporate Governance Committee may nominate the nominee(s) for election to our Board of Directors.

We maintain a corporate governance page in the investor relations section of our website at www.netgear.com. This website includes, among other items, profiles of all of our directors and officers, charters of each committee of the Board, our corporate governance guidelines, our code of ethics, the information regarding our whistleblower policy, and our director and officer stock ownership guidelines.

Our policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of the NASDAQNasdaq Stock Market and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including:

A majority of the members of the Board are independent directors, as defined by the NASDAQNasdaq Marketplace rules. Independent directors do not receive consulting, legal or other fees from us other than standard Board and Committee compensation.

Mr. Waechter serves as the lead independent outside director.

The independent directors of the Board meet regularly without the presence of management.

13

Directors stand for re-election every year. Pursuant to our corporate governance guidelines, it isBylaws and our policy thatCorporate Governance Guidelines, any nominee for director in an uncontested election who receives a greater number of votes “withheld” from“against” his or her election than votes “for” such election shall submit his or her offer of resignation for consideration by our Nominating and Corporate Governance Committee and our Board of Directors.

The Audit, Compensation, and Nominating and Corporate Governance Committees each consist entirely of independent directors.

The charters of the Board committees clearly establish their respective roles and responsibilities.

At least annually, the Board reviews our business initiatives, capital projects and budget matters.

The Audit Committee reviews and approves all related party transactions.

The Board has implemented a process of periodic self-evaluation of the Board and its Committees.

As part of our Whistleblower Policy, we have made a “whistleblower” hotline available to anyone, including all employees, for anonymous reporting of financial or other concerns. The Audit Committee receives directly, without management participation, all hotline activity reports, including complaints on accounting, internal controls or auditing matters.

Directors are encouraged to attend our annual meeting. While their attendance iswas not required, atall of our directors attended the 20152019 Annual Meeting of Stockholders all of our then-continuing directors attended in person.

Directors and officers are encouraged to hold and own common stock of the Company to further align their interests and actions with the interest of our stockholders, pursuant to our director and officer stock ownership guidelines.

Under our insider trading policy, directors and employees, including our executive officers, are prohibited from hedging or pledging of the Company's securities and from investing in derivatives of the Company's securities.

Corporate Social Responsibility and Sustainability

Closely related to our corporate governance efforts, and holding a similarly important place among our corporate values, are our policies and programs relating to corporate social responsibility and sustainability. We maintain sections of our website on these topics at www.netgear.com. These sections include information about our practices in the areas of ethics, labor with dignity, regulatory and environmental compliance, health and safety, management systems, privacy and community support. For example, our culture of integrity is one of our most important core values, codified in our Code of Business Ethics and our Anti-Corruption Compliance Policy. We also hold our manufacturing partners and other suppliers to similarly high standards, reflected in our Supplier Code of Conduct. These values are key to how we conduct our business globally.

14

NETGER is committed to providing our customers with high quality products that are environmentally sound and to conducting our operations in an environmentally responsible manner. We are committed to complying with local laws and regulations in jurisdictions in which we operate, and we plan for the recycle, reuse or reclamation of our products and packaging. As electronic waste continues to grow, NETEAR is responding by reducing or eliminating hazardous materials in our products, helping to protect the health and safety of our employees, our customers, our manufacturing partners and the environment. These commitments continue to be a driving force at NETGEAR, and reflect principles deeply ingrained in our values.

Although we do not currently formally report our extensive corporate efforts in these areas within a particular disclosure framework, our near-term intention is to begin to use SASB standards for reporting key information to our stockholders.

Review, approval or ratification of transactions with related parties

We, or one of our subsidiaries, may occasionally enter into transactions with certain “related parties.” Related parties include our executive officers, directors, nominees for directors, or 5% or more beneficial owners of our common stock and immediate family members of these persons. We refer to transactions in which the related party has a direct or indirect material interest as “related party transactions.” Each related party transaction must be reviewed and approved by the Audit Committee of the Board of Directors prior to the entering into of such transaction.

The Audit Committee considers all relevant factors when determining whether to approve a related party transaction including, without limitation, the following:

the extent of the related party's interest in the related party transaction;

the aggregate value of the related party transaction;

the benefit to the Company; and

whether the transaction involves the provision of goods or services to the Company that are available from unaffiliated third parties and whether the transaction is on terms and made under circumstances that are at least as favorable to the Company as would be available in comparable transactions with or involving unaffiliated third parties.

2019 Related Party Transactions

We have determined that there were no related party transactions to disclose in 2019.

We believe that effective corporate governance should include regular, constructive conversations with our stockholders. We value our stockholders' continued interest and feedback, and we are committed to maintaining an active dialogue to ensure that we understand our stockholders' priorities and concerns, particularly with respect to our executive compensation practices and corporate governance policies. We endeavor to be accessible to our stockholders to address questions and concerns as they arise, as well as to pro-actively conduct outreach efforts. The Company

15

regularly engages in substantial communications and numerous meetings with many of its significant stockholders to discuss the Company’s business strategy, its corporate governance and related efforts, and to listen to feedback from these stockholders.

Additional examples of recent outcomes from these stockholder engagement efforts include:

our Board's decision to pro-actively adopt amendments to our Bylaws and our corporate governance guidelines in 2018 to implement a more robust majority voting policy for uncontested director elections;

our Board's decision to pro-actively propose amendments to our Certificate of Incorporation and Bylaws at our 2017 Annual Meeting to allow stockholders to request special stockholder meetings in certain circumstances;

the final design of our 2016 Equity Incentive Plan, on which we sought specific input from many of our largest institutional stockholders in advance of our 2016 Annual Meeting, where stockholders approved this new equity plan by a significant margin;

our Board's decision to pro-actively adopt amendments to our Bylaws in 2016 to implement proxy access, following input from a number of our large institutional stockholders; and

our Board's decision to pro-actively propose amendments to our Certificate of Incorporation and Bylaws at our 2015 Annual Meeting to eliminate supermajority stockholder vote requirements and replace them with majority vote requirements.

In addition, as described further under Compensation Discussion and Analysis below, the results of our annual say-on-pay advisory votes have demonstrated consistent and significant support for our approach to executive compensation. We also consistently receive positive feedback from institutional stockholders regarding our corporate governance policies and practices.

The Board believes that the Company's Chief Executive Officer is best situated to serve as Chairman because he is the director most familiar with the Company's business and industry, and most capable of effectively identifying strategic priorities and leading any discussion about the Company's business. Given Mr. Lo's history as a co-founder of the Company, the Board believes this rationale is particularly strong. The Board and management have different perspectives and roles in strategy development. The Company's independent directors bring experience, oversight and expertise from outside the Company and from industry, while the Chief Executive Officer brings company-specific experience and expertise. The Board believes that the combined role of Chairman and Chief Executive Officer promotes strategy development and execution, and facilitates information flow between management and the Board, which are essential to effective governance.

One of the key responsibilities of the Board is to develop strategic direction and hold management accountable for the execution of strategy once it is developed. The Board believes the combined role of Chairman and Chief Executive Officer, together

Mr. Waechter has served as the lead independent director since July 2013. Dr. Shimer also serves as the Chair of the Nominating and Corporate Governance Committee.January 2019. As the lead independent director, Dr. ShimerMr. Waechter has the responsibility of presiding at all executive sessions of the Board, consulting with the Chairman and Chief Executive Officer on Board and committee meeting agendas, presiding over any portions of Board meetings at which the evaluation or compensation of the Chief Executive Officer is presented or discussed, presiding over any portions of Board meetings at which the performance of the Board is presented or discussed, acting as a liaison between management and the non-management directors, including maintaining frequent contact with the Chairman and Chief Executive Officer and advising him or her on the efficiency of the Board meetings, and facilitating teamwork and communication between the non-management directors and management.

The Board has an active role, as a whole and also at the committee level, in overseeing management of the Company's risks. The Board regularly reviews information regarding the Company's credit, liquidity and operations, as well as the risks related thereto. The Company's Compensation Committee is generally responsible for overseeing the management of risks relating to the Company's executive compensation plans and arrangements. The Audit Committee oversees management of financial risks. The Nominating and Corporate Governance Committee manages risks associated with the independence of the Board of Directors and potential conflicts of interest. The Cybersecurity Committee oversees the Company's management of risks associated with enterprise cybersecurity and related matters. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks. In addition, the Company has a Risk Committee that reports to the Board at least annually regarding its findings on enterprise risk and the Company's management of this risk. The Risk Committee is led by the Company's internal audit team and is composed of department heads and leaders across the Company. The Risk Committee meets on a regular basis and reviews enterprise risk across the Company's various functional groups.

Succession Planning

The Board plans for succession to the position of CEO and other senior management positions to help ensure continuity of leadership. To assist the Board in this effort, the CEO provides the Board with an assessment of other executives and their potential as a suitable successor. The CEO and senior management also provide the Board with an assessment of individuals considered to be potential successors to certain other senior management positions. The Board discusses and evaluates these assessments, including in private sessions, and provides feedback to the CEO. Management is responsible for developing retention and development plans for potential successors, and periodic progress reports and reviews are provided to the Board.

17

Annual Cash Retainers

Each non-employee member of the Board receives a $35,000 annual retainer. The lead independent director of the Board and members and chairpersons of each Board committee receive the additional annual retainers described below:

Lead Independent Director. The lead independent director receives an additional annual retainer of $25,000.

Audit Committee. Each member (including the chairperson) of the Audit Committee receives an annual retainer of $12,500, and the chairperson receives an additional annual retainer of $20,000.

Compensation Committee. Each member (including the chairperson) of the Compensation Committee receives an annual retainer of $7,500, and the chairperson receives an additional annual retainer of $10,000.

Cybersecurity Committee. Each member (including the chairperson) of the Cybersecurity Committee receives an annual retainer of $10,000, and the chairperson receives an additional annual retainer of $15,000.

Nominating and Corporate Governance Committee. Each member (including the chairperson) of the Nominating and Corporate Governance Committee receives an annual retainer of $5,000, and the chairperson receives an additional annual retainer of $6,000.

All retainers are paid on a quarterly basis following the end of each quarter and are pro-rated, as needed, for partial service during such period.

Equity Compensation

Annual RSU Grant. On an annual basis, each non-employee director is eligible to receive an annual grant of a number of restricted common stock units equal to $200,000 divided by the Nasdaq Stock Market closing price of the Company’s common stock on the date of the annual stockholder meeting (rounded down to the nearest whole share), which will become fully vested on the date of the following year’s annual stockholder meeting.

Initial RSU Grant. Upon joining the Board, each non-employee director is eligible to receive an initial grant of restricted common stock units, in an amount equal to the value of the annual $200,000 grant pro-rated based on the length of services provided from appointment/election to the Board until the following annual stockholder meeting. The restricted stock units will become fully vested on the date of the following year’s annual stockholder meeting.

Continuing Education

In order to encourage continuing director education, the Company also has established a budget for external director education of $7,000 over a two-year period for each director. Directors serving on multiple boards are encouraged to obtain pro-rata reimbursement of their director education expenses from each corporation that they serve. Biennially, the Company arranges a specific continuing education session for the Board, as a whole, to attend in connection with one of its regularly scheduled meetings.

18

The Company’s non-employee directors are entitled to reimbursement for travel (first-class domestic and business-class international airfare) and other related expenses incurred in connection with their attendance at meetings of the Board and Board committees.

The following Director Compensation Table sets forth certain information regarding the compensation of our non-employee directors for the 20152019 fiscal year.

Name |

| Fees Earned In Cash ($) |

|

| Stock Awards ($) (1) |

|

| Option Awards ($) (2) |

|

| Total ($) |

| ||||

Laura J. Durr (3) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Jef T. Graham (4) |

|

| 55,833 |

|

|

| 199,977 |

|

|

| — |

|

|

| 255,810 |

|

Bradley L. Maiorino (4) |

|

| 72,500 |

|

|

| 199,977 |

|

|

| — |

|

|

| 272,477 |

|

Maureen M. Mericle (5) |

|

| — |

|

|

| 93,689 |

|

|

| — |

|

|

| 93,689 |

|

Janice M. Roberts (4) (6) |

|

| 42,500 |

|

|

| 251,621 |

|

|

| — |

|

|

| 294,121 |

|

Gregory J. Rossmann (4) |

|

| 62,500 |

|

|

| 199,977 |

|

|

| — |

|

|

| 262,477 |

|

Barbara V. Scherer (4) |

|

| 75,000 |

|

|

| 199,977 |

|

|

| — |

|

|

| 274,977 |

|

Thomas H. Waechter (4) |

|

| 77,831 |

|

|

| 199,977 |

|

|

| — |

|

|

| 277,808 |

|

| Name | Fees Earned In Cash ($) | Stock Awards ($) (1) | Option Awards ($) (2) | Total ($) | ||||||||

| Jocelyn E. Carter-Miller (3) | 47,000 | 199,973 | — | 246,973 | ||||||||

| Ralph E. Faison (3) | 51,000 | 199,973 | — | 250,973 | ||||||||

| A. Timothy Godwin (3) | 44,667 | 199,973 | — | 244,640 | ||||||||

| Jef T. Graham (3) | 41,000 | 199,973 | — | 240,973 | ||||||||

| Linwood A. Lacy, Jr. (4) | 17,500 | — | — | 17,500 | ||||||||

| Gregory J. Rossmann (3) | 45,000 | 199,973 | — | 244,973 | ||||||||

| Barbara V. Scherer (3) | 57,333 | 199,973 | — | 257,306 | ||||||||

| Julie A. Shimer (3) | 62,000 | 199,973 | — | 261,973 | ||||||||

| Thomas H. Waechter (3) | 39,000 | 199,973 | — | 238,973 | ||||||||

(1) | |

The amounts included in the “Stock Awards” column represent the full grant date value of non-option stock awards (restricted stock units) granted in |

(2) | |

As of December 31, |

(3) | Ms. Durr joined our Board in January 2020. |

(4) | On |

(5) | |

On December 9, 2019, Ms. Mericle was issued 3,846 restricted stock units in connection with her appointment to the Board, which vest entirely on the date of |

(6) | On February 26, 2019, Ms. Roberts was issued 1,463 restricted stock units in connection with her appointment to the Board, which vested entirely on the date of the 2019 Annual Meeting of Stockholders. The grant of these restricted stock units had a grant date fair value of $51,644. |

Our Board of Directors has adopted stock ownership guidelines for our directors and executive officers, effective as of January 1, 2005.officers. The guidelines require our directors to own a minimum of 5,000 shares of NETGEAR common stock. Directorsstock, including restricted stock, restricted stock units and similar instruments. New directors have a five yearfive-year period in which to achieve the required compliance level. Shares owned directly by a director and all unvested restricted stock units are counted toward the guidelines. All of our directors are currentlywere in compliance with the guidelines.

Our Compensation Committee is responsible for recommending to our Board of Directors salaries, incentives and other forms of compensation for officers and other employees. None of the members of the Compensation Committee is currently or has been at any time an officer or employee of NETGEAR or a subsidiary of NETGEAR. There were no interlocks or insider participation between any member of the Board of Directors or Compensation Committee and any member of the Board of Directors or Compensation Committee of another company.

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

In accordance with its charter, the Audit Committee has selected PricewaterhouseCoopers LLP, independent registered public accounting firm, to audit our financial statements for the fiscal year ending December 31, 20162020 and, with the endorsement of our Board of Directors, recommends to stockholders that they ratify that appointment. PricewaterhouseCoopers LLP served in this capacity for the year ended December 31, 2015.2019. A representative of PricewaterhouseCoopers LLP will be present at the annual meeting and will have the opportunity to make a statement if he or she desires to do so and be available to answer any appropriate questions.

The following table is a summary of the fees billed to us by PricewaterhouseCoopers LLP for professional services for the years ended December 31, 20152019 and December 31, 2014:2018:

Fee Category |

| 2019 Fees |

|

| 2018 Fees |

| ||

Audit Fees |

| $ | 2,163,577 |

|

| $ | 3,099,344 |

|

Audit-Related Fees |

|

| — |

|

|

| 4,317,000 |

|

Tax Fees |

|

| 773,061 |

|

|

| 2,160,801 |

|

All Other Fees |

|

| 4,500 |

|

|

| 4,500 |

|

Total Fees |

| $ | 2,941,138 |

|

| $ | 9,581,645 |

|

| Fee Category | 2015 Fees | 2014 Fees | ||||||

| Audit Fees | $ | 1,713,175 | $ | 1,779,130 | ||||

| Audit-Related Fees | 5,837 | 7,921 | ||||||

| Tax Fees | 369,405 | 324,788 | ||||||

| All Other Fees | 3,600 | 3,600 | ||||||

| Total Fees | $ | 2,092,017 | $ | 2,115,439 | ||||

Audit Fees.

Consists of fees billed for professional services rendered for the audit of our consolidated financial statements and internal control over financial reporting and review of our quarterly interim consolidated financial statements, as well as services that are normally provided by PricewaterhouseCoopers LLP in connection with statutory and regulatory filings or engagements.Audit-Related Fees. Consists of fees billed for consultationsservices that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported above under the caption “Audit Fees.” In 2018, these fees included services relating to the review of Arlo's registration statement on Form S-1 and amendments thereto, comfort letter procedures and other matters in connection with Sarbanes-Oxley compliance, acquisitions, as well asthe Arlo IPO, audit of historical carve-out financial statements of Arlo, interim reviews of certain historical financial statements, fees related to carve-out accounting and presentation matters, and additional consultations concerning financial accounting and reporting standards.

Tax Fees.

Consists of fees billed for professional services including assistance regarding federal, state and international tax compliance and related services, as well as professional services for tax advice and tax planning.All Other Fees. Consists of fees billed for use of an online accounting research tool and disclosure checklist tool provided by PricewaterhouseCoopers LLP.

21

Before selecting and prior to determining to continue its engagement for 20162020 with PricewaterhouseCoopers LLP, the Audit Committee carefully considered PricewaterhouseCoopers LLP's qualifications as an independent registered public accounting firm. This included a review of the qualifications of the engagement team, the quality control procedures the firm has established, as well as its reputation for integrity and competence in the fields of accounting and auditing. The Audit Committee's review also included matters required to be considered under the Securities and Exchange Commission's rules on auditor independence, including the nature and extent of non-audit services, to ensure that the auditors' independence will not be impaired. The Audit Committee pre-approves all audit and non-audit services provided by PricewaterhouseCoopers LLP, or subsequently approves non-audit services in those circumstances where a subsequent approval is necessary and permissible. All of the services provided by PricewaterhouseCoopers LLP described under “Audit-Related Fees,” “Tax Fees,” and “All Other Fees” were pre-approved by the Audit Committee. The Audit Committee of our Board of Directors has determined that the provision of non-audit related services by PricewaterhouseCoopers LLP is compatible with maintaining the independence of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm is not required by our amended and restated bylaws or other applicable legal requirement. However, our Board of Directors is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, our Audit Committee and Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee at its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests and in the best interests of our stockholders.

The affirmative vote by a majority of shares present in person or by proxy at the annual meeting and entitled to vote is required to approve this proposal.

Our Board of Directors has unanimously approved this proposal and recommends that stockholders vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31,22

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Notwithstanding any statement to the contrary in any of our previous or future filings with the Securities and Exchange Commission, this report of the Audit Committee of our Board of Directors shall not be deemed “filed” with the Securities and Exchange Commission or “soliciting material” under the 1934 Act, and shall not be incorporated by reference into any such filings.

The Audit Committee, which currently consists of Barbara V. Scherer (Chair), Laura J. Durr, Bradley L. Maiorino and Janice M. Roberts, evaluates audit performance, manages relations with our independent registered public accounting firm and evaluates policies and procedures relating to internal accounting functions and controls. Our Board of Directors first adopted a written charter for the Audit Committee in September 2000 and most recently amended it in April 2020, which details the responsibilities of the Audit Committee. This report relates to the activities undertaken by the Audit Committee in fulfilling such responsibilities.

The Audit Committee members are not professional auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent registered public accounting firm. The Audit Committee oversees NETGEAR's financial reporting process on behalf of our Board of Directors. NETGEAR's management has the primary responsibility for the financial statements and reporting process, including NETGEAR's system of internal controls over financial reporting. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2019. This review included a discussion of the quality and the acceptability of NETGEAR's financial reporting and internal control over financial reporting, including the clarity of disclosures in the financial statements.

The Audit Committee also reviewed with NETGEAR's independent registered public accounting firm, who are responsible for expressing an opinion on the conformity of NETGEAR's audited financial statements with U.S. generally accepted accounting principles ("GAAP"), their judgments as to the quality and the acceptability of NETGEAR's financial reporting and such other matters required to be discussed with the Audit Committee under generally accepted auditing standards in the United States, including those described in Auditing Standard No. 1301, "Communications with Audit Committees," as adopted and as may be amended from time to time by the Public Company Accounting Oversight Board (the “PCAOB”). The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountant's communications with the Audit Committee concerning independence. The Audit Committee discussed with the independent registered public accounting firm such auditors' independence from management and NETGEAR, including the matters in such written disclosures required by applicable requirements of the PCAOB regarding the independent accountant's communications with the Audit Committee concerning independence.

The Audit Committee further discussed with NETGEAR's independent registered public accounting firm the overall scope and plans for their audits. The Audit Committee meets periodically with the independent registered public accounting firm, with and without management present, to discuss any significant matters regarding internal control over financial reporting that have come to their attention during the audit, and to discuss the overall quality of NETGEAR's financial reporting.

23

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to our Board of Directors and our Board of Directors approved that the audited financial statements and disclosures under “Management's Discussion and Analysis of Financial Condition and Results of Operations” be included in the Annual Report on Form 10-K for the year ended December 31, 2019, as filed with the Securities and Exchange Commission on February 18, 2020.

Respectfully submitted by:

THE AUDIT COMMITTEE

BARBARA V. SCHERER (CHAIR)

LAURA J. DURR

BRADLEY L. MAIORINO

JANICE M. ROBERTS

24

APPROVAL OF NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

Executive compensation is an important matter for NETGEAR and our stockholders. This proposal gives our stockholders the opportunity to cast an advisory vote to approve compensation to our executive officersNamed Executive Officers set forth in the Summary Compensation Table (the “Named Executive Officers”).

Our executive compensation programs aim to address a number of objectives, such as attracting and retaining highly qualified executive officers, rewarding individual contribution, loyalty, teamwork and integrity, and motivating our Named Executive Officers to achieve returns for our stockholders. We believe our compensation program is strongly aligned with the long-term interests of our stockholders. Furthermore, we believe that the various elements of our executive compensation program combine to promote our goal of ensuring that total compensation should be related to both NETGEAR's performance and individual performance.

We urge you to carefully read the Compensation Discussion and Analysis (“CD&A”) section of this proxy statement for additional information regarding our executive compensation, including our compensation philosophy and objectives, and the 20152019 compensation of the Named Executive Officers. The following highlights important aspects of executive compensation with respect to our Named Executive Officers in fiscal year 2015:

Approximately 70%77% of total target compensation for our Named Executive Officers is variable and tied to achievement of internal performance targets or Company performance;

We granted long-term equity awards (four-year standard vesting) that link the interests of our Named Executive Officers with those of our stockholders;stockholders, including stock options that generally vest over four years and only increase in value with an increase in the market price of our common stock, and restricted stock units that generally vest over four years;

Named Executive Officers are not entitled to any tax gross-up treatment on any severance, change-of-control benefits or other benefits; and

We have clawback provisions for the executive bonus plan for Named Executive Officers and stock option and restricted stock unit award agreements for Named Executive Officers.